A Look At The worlds Most Hated Resource

Nov.27.15

It seems that almost everyone the world over hates mining. There seems to be no one other than miners who have anything good to say about any kind of mining. But hey, all these NIMBYS and eco types all love to drive their sport utility, drink their starbucks and somehow they all embrace technology, which by the way is very resource intensive. So whether it be gold mining, silver mining or even dirty old coal mining, people are going bitch. But there is one resource that it seems everyone dislikes and complain about the most and that resouce is on a comeback and will possibly be the fastest growing commodity in the nest decade. What is it? Uranium!

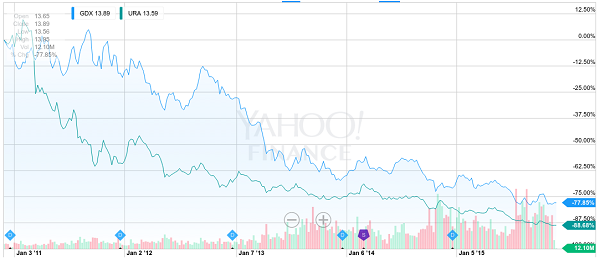

If you go by the Global X Uranium ETF, Uranium stocks in general have lost nearly 90% of their value in the last five years. This is all because of Fukushima. You remember, the big tsunami that came through and wiped out a whole lot of Japan. Anyhow at the time, Japan got most of it's power from nuclear power which of course needs uranium to make the power. After the dust settled in Japan there was a sort of moritorium and halt to nuclear reactors and nuclear power. However now they are faced with a problem. A country with an economy in a mess and failing infastructure and it needs new sources of power. The answer? Back to nuclear. After all it done right it is the safest, cleanest energy you will get when it come to power for the masses.

I know, there are lot out there that will say go solar but the reality is that solar does not deliver 100% effecient power. Even under ideal conditions solar still needs a back up of some sort. So nuclear seems to be the answer today at least for Japan. Japan is restarting its reactors right now. Two have now reached commercial operation with two more slated to come online early next year. China has 26 reactors and is building 23 at present and plans to build 172 more. It also just partnered with Romania and Argentina to build reactors in those countries.

Stockpiles of uranium there were accumulated decades ago are diminishing. These supplies have nearly halved since 2013. Global uranium demand is expected to rise 40% by 2025. Annual growth of 2.8% might not sound like a lot, but is massive for a commodity that has seen virtualy nodemand growth since the 1980s. Consider that average annual copper demand growth of less than 3% from 2002 to 2012 was enough to drive a 336% price increase.

Now as I mentioned the uranium sector is beat down to a pulp and the junior miners that are out looking for this stuff are at bargain basement prices. Those who have properties and cash will give investors and good return over the next few years. One of the players in this field is NexGen NXE. They are active in the Patterson Lake area of northern Saskatchewan.These guys however aren't at 52 week lows in the stock price because of good drilling results in a hot area.

Fission Uranium FCU is another player in the Patterson Lake region. It's stock price is rock bottom right now. Denison Mines DML is a uranium exploration and development company with interests in exploration and development projects in Canada, Zambia, Namibia, and Mongolia. Including the high grade Phoenix deposits, located on its 60% owned Wheeler project. Stock price at lows. Laramide LAM offers exposure to uranium assets through its portfolio of projects chosen for their production potential and location in safe and politically stable jurisdictions, including Westmoreland in Australia and two development stage assets, La Sal and La Jara Mesa, in the United States.

So if you are geting tired of seeing your favorite gold stock getting pounded to death and want to expore the potential of a uranium stock, now would be a good time for doing that sort of home work. I have a list of uranium stocks in the directory HERE. Some of the list may be redundant by now as it hasn't been updated for a while but you can still sift through and maybe find a few that offer some potential.

As always, use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.

GAdams