Building A Mineral Bank

Most junior mining companies spend their entire existence on searching for the perfect chunck of property that will deliver a deposit of some kind. Once that property is found the company will go to investors and public markets to raise money to explore and drill and eventually prove up that property so that the property could be optioned or joint ventured or maybe even see themselves getting bought out by a midtier or major mining company.

First Mining Finance FF does the same sort of thing in that it aquires properties of merit, but after it does it's due diligence and exploration work to prove the viability of the property, it will option the property out to another company. This other company will be able to prospect, explore and drill with the options of earning a percentage of the property or eventual ownership of the property. What First Mining gets is a form of royalty once the property goes into production.

From the website it states: Our mineral bank business model is to acquire mineral assets for exceptionally low prices and to hold those assets until the capital markets for mining improves. At that point we would add value for our shareholders by entering into agreements with third parties that would move the projects forward while First Mining holds residual interests in the projects.

The company has a huge portfolio of mineral properties. As of this date there is a total of 25 different property at varying degrees of exploration. These properties total over 300,000 hectares of land that is located in Canada, USA and Mexico. Mineral of interest are gold, silver, copper, lead, zinc, and iron-ore with gold being the main focus.

Some of these properties are world class. One such property is the Springpole Gold Project which is located in northern Ontario, Canada. Springpole has an Indicated Resource of 128.2 Mt grading 1.07 g/t Au, containing 4.41 million ounces of gold and an Inferred Resource of 25.7 Mt grading 0.83 g/t, containing 0.7 million ounces of gold. The Hope Brook property in Newfoundland has indicated resource of5.5 Mt at 4.77 g/t Au containing 844,000 ounces of gold and an inferred resource of 0.84 Mt at 4.11 g/t Au containing 110,000 ounces of gold.

First Mining holds a property in Nevada that is comprised of 1562 hectares located along the Battle Mountain-Eureka Trend, 16 kms south of Barrick Gold Corp.'s Cortez Mine Complex, nine kms west of its Gold Rush deposit and 1.5 kms east of the Toiyabe Mine. In Mexico the company holds 12 properties that all contain known mineralization and are at various states of exploration. These properties are located in Sonora, Oaxaca and Durango.

The company has top notch management with Keith Neumeyer as chairman. Keith Neumeyer is the CEO of First Majestic which is one of the largest silver miners in the world. First Majestic owns producing silver mines throughout Mexico.

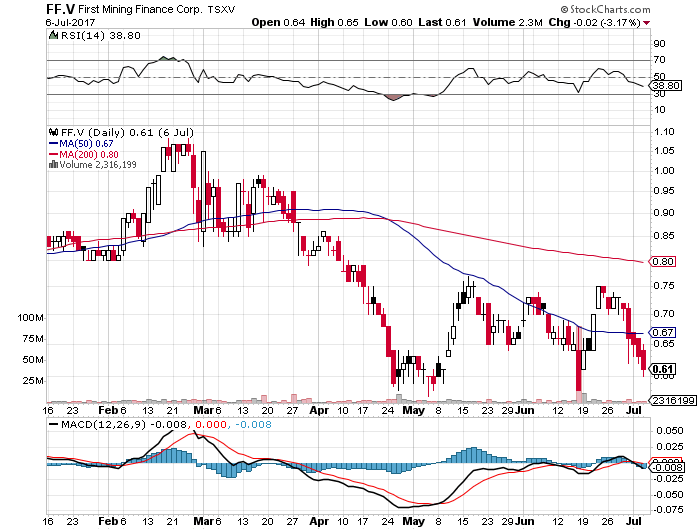

Of course one look at the stock chart above and it paints sort of a dismal picture. One of the reasons is that First Mining is part of the GDXJ and rules are changing within that ETF as to how many juniors and what percentage of the stock the ETF will own. Some funds of course have strict guidelines and need to lessen their exposure. However it has been noted that the company has migrated from the venture board over to the TSX big board. Being on the TSX allows the company to be of investment interest to other types of funds and investments and we could very well see the stock price appreciate. Of course we may very well have to wait until this sell off of precious metals ends.

As always, use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.

GAdams

Editor's Note: The editor of this article owns stock in First Mining at the time of this writing.