Looking For An Undervalued Silver Junior?

Over the last few months it seems that I have been noticing a lot more articles, videos and write ups about a coming silver boom. Maybe I watch to many conspiracy videos but either way you look at it, silver is one of the most undervalued commodities on the planet. I did an article just a bit ago talking about this same topic and decided that this may be a good time to search out an undervalued silver junior for the long haul. After all if silver goes to $1000 an ounce like some people say, it would be nice to have piece of the pie and the bigger the piece the better.

Of course right now pretty much all the silver miners stock prices are at 52 week lows or shall I say "all time lows". So being able to pick up stock for a longer term hold as in say a couple years, there is a lot to choose from when it comes to bargains. One of these stocks that could possibly be added to a list while I was searching is Klondike Silver KS which is a junior silver explorer that has vast amounts of properties in kootenay region of British Columbia.

Klondike Silver's main property is in the Slocan Mining Camp which is over one hundred

square kilometres in size and is owned by the company 100% royalty free. Their property contains over 58% of the historical silver

producing mines in the Slocan Silver Camp. This silver camp has produced over 40 million troy ounces of silver and even though this property has produced these great amounts of silver, there still is many areas of this camp left to explore.

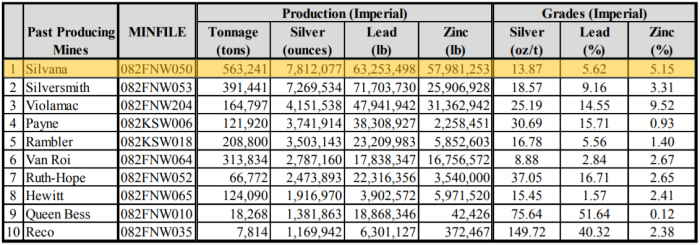

Top 10 Silver Past-Producing Mines within the Klondike Silver Claim Block

During 2017 the company spent most of its time doing rehabilitaion work on different portals along with GPS work, mapping and survey work in preparations for continued drilling and exploration. Work for 2018 will entail, some proposed underground drifting and diamond drilling from the extensions of the Silvana and Carnation workings.

They will also continue to compile and combine historical data into the 3D model and continue to upgrade the mine and mill infrastructure in preparation of commencement of operations, possibly within the 2018 year.

So getting back to bargain part of the article I would like to mention first off I have not looked into any of the financials of the company at all. This fast look is a just a quick overview only.

The stock price as of January 10, 2018 is 5 cents and the company has about 110 million shares out. While I was looking at the chart I noticed that over the past year the stock had a high of just 11 cents and that was almost a year ago. However once I expanded the time line all the way back to 2006 I noticed that the stock was at one time right around the $16 dollar range. At first I was quite surprised that the stock price could have been that high so I checked a few other charting sites and found that the price had in fact been $16 a share. Since 2011 however the stock has been languishing well under a dollar. Both lead and zinc prices are up year over year and are poised for more upside. The question remains if and when the price of silver goes up, and how high, what effect will that have for the stock price of Klondike Silver if any? Of course I'm not here to tell anyone to buy or not because I am not allowed to but if you are like me looking for an undervalued silver miner, do your own due diligence as there could be some good possibilities if and when the silver price does get moving this year.

As always, use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.

GAdams