Silver Prices Are Set To Soar

There has been a lot of talk and chatter on the net the last few weeks in the silver camp about the price of silver being primed to take off. There has been some pretty interesting articles in the last little while that tell you the reasons why silver is heading higher. Of course there is also a bear camp that has all the stats that can show all the reasons why silver won't go up any time soon also. But for conversations sake we will stick with the silver bull camp and look at the reasons why it is about to explode.

The first article I read was quite interesting as it explains that there is only a certain amount of value in the worlds economy and its all about how that value is invested. The author uses a method called fractals to measure and analyse everything using time and valuation. With this data the author goes onto say that the value of equities like big stocks have gotten to an over valued point. Realestate in most cases is over valued. Almost every tangible item of value is overvalued at the present time except oil, precious and base metals. Oil might be undervalued but as he explains there is just too many factors that could push oil down again. Factors like Iran or Saudia that could dump millions if not billions of barrels of oil out on whim driving the prices down just to elimenate competition.

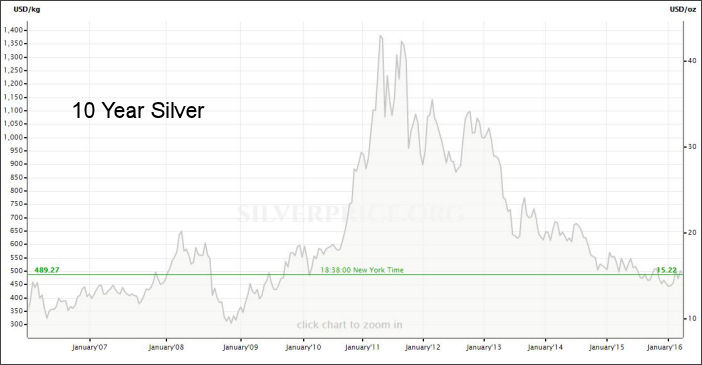

With base metals there is also too much uncertainty in the world economy as far as expansion goes so things like copper or base metals are questionable. All this leads to the precious metals like gold and silver. The reasoning for silver is because it is the cheapest out there. Silver is like picking a penny stock. It's only human to pick through and look for the bargains. Our thinking tends to tell us that if we buy a 2 cent stock, we only need a 2 cent rise to 4 cents to double our money. So it is the same mentality that would say that silver being only $15-$16 per oz that it only needs to go to $30-$32 for me to double my money. Whereas with gold it would need to break a new high and need to get beyond $2,400 an oz for a double.

Another person Bo Polny who uses cycles and time to analyse trends and commodities is basically saying the same thing. His call is for triple digit silver this year in 2016. Of course we read lots of articles stating that certain banks have hoarded all the physical silver there is. This is the explaination that a lot of silver stackers use pointing to the fact that bothgovernment and private mints have run out of physical silver for minting but yet the paper silver price remains the same or even goes down. Of course the entire gold or silver market is the smallest markets on the planet money wise so it would not take much for any one nation or even a large corporation to actually take over the complete market if they could actually get their hands on all the material.

All the gold and silver that is traded, is just paper. There is something like 100 oz of paper silver or gold for every physical oz of metal so the day may come when some unlucky people find that silver they supposedly own is not worth the PAPER it is written on. Either way going by these writers this past week it should be an interesting time coming up if any of this stuff actually transpires. I've read lots of these theories over the years and I have developed an "I'll wait and see" attitude. But as a gold and silver bug I have always said that owning a bit of either is a great way to hold some money as a saving. And while I'm talking silver here, make sure you sign up for my newsletter. The form is on the top right hand side of this page and your email goes into the draw for a 1/4 oz silver coin.

If you enjoyed this article, please feel free to share. When seeking out mining stocks alsways use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.